Plastic cards printing, types and utilization of Plastic cards

Due to the flawless texture, PVC cards are often referred to as plastic cards. This cards required processors other than typical consumer-grade laser or inkjet printers.

The mechanism of thermal diffusion is unique to plastic cards.A colourful coating from a strip is applied to the smooth, silicone surface in this technique. A thermal printing unit raises the heat of the ribbon’s colour layer to achieve this transfer.

This layer becomes gas during colour printing and then goes back to a stable form on the silicone card’s surface layer. Sublimation is the term for this procedure.Plastic cards are printed for a variety of purposes. These include payment cards issued by financial institutions.

These also include business cards, membership cards, etc.These have professional look and are long-lasting.

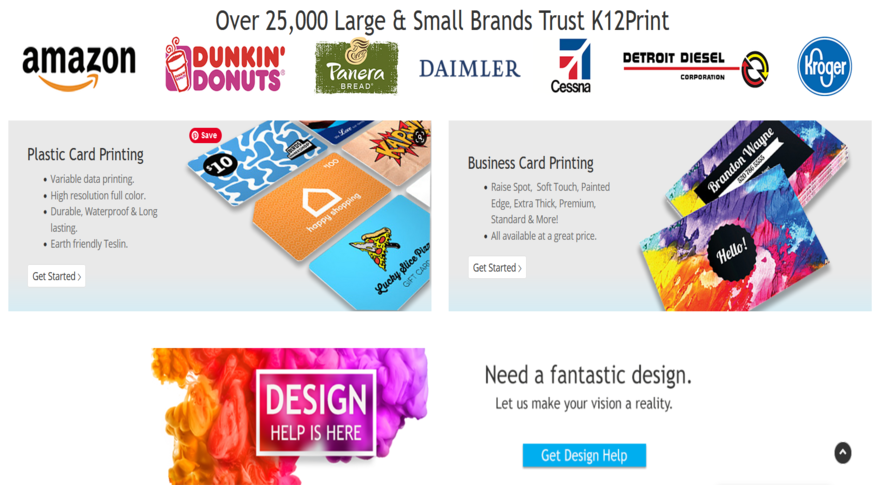

Plastic Card Printing

- Plastic Card Printing

- Bar code card

- Contactless cards

- Gift cards

- Membership cards

- Cards that allow access controls

- Credit Cards

- Debit Cards

These cards are printed using electronic printers. These printers are capable of printing cards with customized requirements. It enables businesses to get a customized design for their cards.

The plastic card printing uses software that is pre-designed with punching, laminating and striping functions. Plastic cards come in a variety of forms. Also, they serve a variety of purposes. Some of these cards are discussed in detail.

-

Bar code card

These are cards with a set of vertical lines printed on them. These lines are codes that represent alphabets, numbers and symbols. Each vertical line is of different measurement. Each one has a certain meaning as per international standards.

These barcodes contain details about the cardholder. They are generally used as membership cards or gift cards. These cards are generally of the size of standard credit cards.

-

Contactless cards

These are smart cards that operate on radio frequencies. The benefit of these cards is that they involve the minimum intervention of humans. The sensors inside the card are capable of completing the transaction just by coming close to the antenna.

-

Gift cards

These cards are generally in the form of bar codes. The bar codes store the value of the card. These can be used as an alternative to cash for making transactions.

The transactions can be made only from the stores or places eligible for making the transaction. They may also have some expiry dates. The benefit of these cards is that the donor does not need to select a specific gift for the person. Also, the recipient can purchase the gift as per his requirement and suitability.

-

Membership cards

These plastic cards work as an entitlement as a member of a particular organization. They are issued by the businesses to gain the loyalty of the customers.

The businesses gain the loyalty of the customers by giving them additional discounts. They may also provide their customers free access to some special services. The customers feel a sense of familiarity by getting these special treatments and they remain loyal to the business or organization.

-

Cards that allow access controls

These cards allow access controls in a particular place. The card stores information about an individual in electronic form. It acts like an electronic ID card. The person has to swipe this card through the card reader. If the card reader identifies the card, the person gains access to the premises.

These cards have strong security. This is because duplicating the card is nearly impossible. Further, one can deactivate it if it gets lost.

-

Credit Cards

This payment card allows the holder of the card to make payment to a merchant. With the help of this card, the issuing organization makes the payment. The cardholder makes the payment to the issuing organization at some later point in time.The benefit of this card is that it allows higher liquidity to the cardholder. Further, it also provides greater purchasing power to the cardholder.

A credit card differs from a charge card. This is because a charge card enables the cardholder to make payment at a later stage. Contrary to this, in credit cards, the financial institution makes instant payments. Later, the cardholder has to make the payment to the financial institution, as stated earlier.

These are the plastic cards that are used like cash transactions. The cardholder makes instant payment to the merchant with the help of this card. However, it is different from credit cards.With a credit card, the financial institution makes instant payment. The cardholder then reimburses the payment.

On the other hand, the cardholder makes the instant payment in the case of a debit card. There are multiple ways through which these plastic cards are issued. There is also multiple utilization of these cards.

The ease of use that these cards provide is the main reason for their popularity. Also, the durable nature of these plastic cards has played an active role in their popularity.

www.businesswebinfo.com is a free guest posting and blogging website with multiple niche which provides content and information related to various topics like Education, Arts etc